Peter and Jeff’s story

Both retired with $200,000 in super

Peter and his friend Jeff are both 72. They both retired in the same year at age 67 and now catch up regularly to go fishing together.

Peter and Jeff were both paid super during their working lives and each saved $200,000 with First Super.

What happened when Jeff switched funds

Before he retired, Peter spoke to one of First Super’s financial planners about how to maximise the money he had saved. His planner recommended that he open a First Super Retirement Income account and start drawing down on his money gradually.

This meant he could still access the Government Age Pension while the balance of his saved money continued to grow during the early years of retirement, before he gradually draws down on all of it.

He knows he has the flexibility to withdraw some additional money for emergencies (or holidays!) if he needs to.

Jeff on the other hand, switched to a retail super fund.

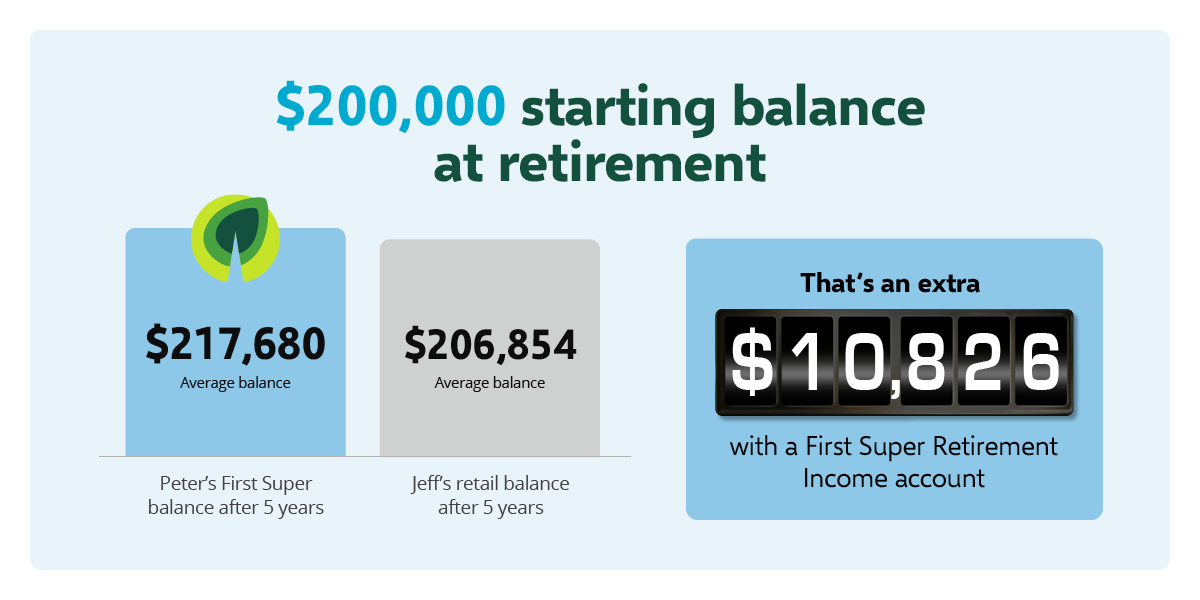

Both Peter and Jeff withdrew 5% of their balance each year for the first five years of retirement and also accessed the Age Pension to top up their incomes.

After the first five years of retirement Peter had a balance of $217,680 in his First Super Retirement Income account, while Jeff only had $206,854 in his retail account.

That’s an additional $10,826 for Peter, simply by sticking with First Super.

Peter’s numbers

| Account balance invested after income taken | Income stream payments | Age Pension payments | Total income | |

| 2019/20 | $200,000 | $10,000 | $18,151 | $28,151 |

| 2020/21 | $187,675 | $9,384 | $18,507 | $27,891 |

| 2021/22 | $208,034 | $10,402 | $18,671 | $29,072 |

| 2022/23 | $199,929 | $9,996 | $19,354 | $29,351 |

| 2023/24 | $208,905 | $10,445 | $20,852 | $31,297 |

| Closing balance | $217,680 |

We’re here to help. So, let’s talk

If you have any questions, call our Member Services team on 1300 360 988, email us or use the Live Chat. The 5% drawdown may not be right for you, so book an appointment with one of our financial planners to discuss your situation or click the link below to find out more about our Retirement Income account.

Peter and Jeff are not actual members. Their stories have been created for illustrative purposes.

Past performance is not a reliable indicator of future performance and should never be the sole factor considered when selecting a fund. Investment return figures follow SuperRatings’ Net Benefit Modelling (including the returns after fees are taken out) applied to all Industry SuperFunds’ performance figures, which is different from First Super’s calculated returns for the same period.

Comparisons modelled by SuperRatings, commissioned by ISA and show average difference of the ‘main pension Balanced option’ of First Super and retail funds tracked by SuperRatings, over a 5 year period. A ‘main pension Balanced option’ being the fund’s largest pension Balanced option where 60% to 76% of the fund’s assets are invested in growth investments. Where a fund does not have a Balanced option, the option closest to SuperRatings’ benchmark range of 60% to 76% growth investments is used. Outcomes vary between individual funds. Modelling performed on 16 October 2024 using data as at 30 June 2024. See firstsuper.com.au/retirement-assumptions for more details about modelling calculations and assumptions.

First Super financial planners are authorised representatives of Industry Fund Services Limited (ABN 54 007 016195, AFSL 232514).

Issued by First Super Pty Ltd (ABN 42 053 498 472, AFSL 223988), as Trustee of First Super (ABN 56 286 625 181). This article contains general advice which has been prepared without taking into account your objectives, financial situation or needs. You should consider whether the advice is appropriate for you. Read the Product Disclosure Statement (PDS) before making any investment decisions. To obtain a copy of the PDS or Target Market Determination please contact First Super on 1300 360 988 or visit our PDS & Publications page.